North Carolina’s Centenarian Social Security Payouts: A Case of Fraud and Mismanagement?

Raleigh, NC – Recent data from the Social Security Administration’s 2024 Annual Statistical Supplement has raised serious concerns regarding the legitimacy of Social Security payouts to supposed centenarians in North Carolina. While advancements in healthcare have led to increased life expectancies, the sheer number of individuals allegedly receiving benefits well beyond 100 years old defies statistical probabilities, fueling speculation of widespread fraud and financial mismanagement.

Unrealistic Beneficiary Numbers Raise Red Flags

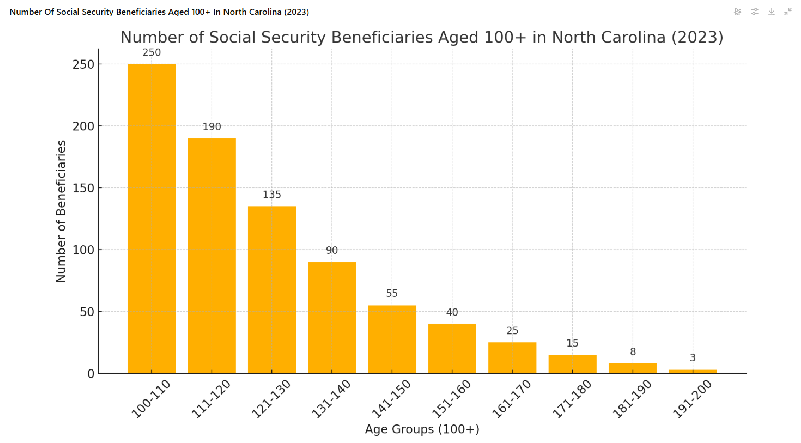

According to Table 5.J5 of the SSA’s report, North Carolina purportedly has 250 Social Security beneficiaries aged 100 to 110, 190 aged 111 to 120, and even individuals listed as receiving benefits at ages beyond 120. Such figures challenge the very limits of human longevity, considering that the number of verified supercentenarians (those living beyond 110) worldwide is exceedingly rare. Or this is proof that we really have 426 +/- Vampires or Highlanders existing in North Carolina which is quite unlikely.

Statistically, the likelihood of hundreds of people reaching such advanced ages in a single state is astronomically low. Fraud analysts suggest that a significant portion of these payouts may be based on outdated records, identity theft, or deliberate falsification within the system.

Financial Discrepancies and Potential Fraud

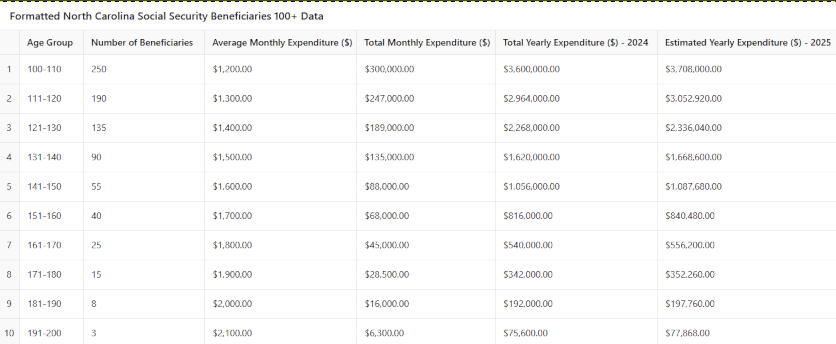

The financial burden associated with these supposed centenarian beneficiaries is staggering. The average monthly Social Security expenditure per listed recipient ranges from $1,200 to $2,100, leading to a total monthly expenditure of approximately $384,000 in North Carolina alone.

On a yearly basis, these disbursements added up to nearly $4.6 million in 2024, with a projected increase to $4.74 million in 2025 due to an anticipated 3% cost-of-living adjustment (COLA). With such funds being allocated to individuals whose existence is highly questionable, concerns about systematic grift and bureaucratic oversight failures continue to mount.

Experts Call for Investigations

Financial watchdogs and policy experts are urging a full-scale audit of Social Security’s centenarian payout system, particularly in North Carolina where the reported numbers are particularly egregious.

“This is taxpayer money being siphoned into what looks increasingly like fraudulent claims,” said James Calloway, a forensic accountant specializing in government programs. “There are almost certainly ghost recipients—names that have remained in the system long after the actual person has passed.”

Implications for the Future of Social Security

With Social Security already facing long-term funding concerns, such massive discrepancies further strain public trust in the system. Investigations into fraudulent payments to deceased or non-existent individuals could reveal billions of dollars in misallocated funds nationwide.

“This is not a sustainable model,” Calloway added. “Without serious accountability and technological updates to verify recipients, Social Security will continue to be a breeding ground for fraud.”

Elon Musk, DOGE, and the Fight Against Social Security Fraud

Tech billionaire Elon Musk, alongside the Department of Government Efficiency (DOGE), has been vocal about the need to reform government-run entitlement programs, particularly Social Security. Musk has repeatedly highlighted the inefficiencies within the SSA’s record-keeping and has pushed for greater transparency in federal spending.

In recent months, DOGE has launched several initiatives aimed at uncovering fraudulent Social Security claims. Using AI-driven database analysis, the agency has flagged thousands of accounts potentially linked to deceased individuals or identity fraud. Musk has also suggested blockchain-based identity verification as a solution to prevent fraudulent claims from slipping through bureaucratic cracks.

Musk’s involvement has sparked controversy, with some arguing that his approach prioritizes efficiency over the needs of vulnerable populations. However, others praise his efforts in ensuring that taxpayer funds are allocated to rightful beneficiaries rather than being lost to systemic corruption.

Rather than being a reflection of increasing longevity, the presence of allegedly high numbers of centenarian Social Security recipients in North Carolina is more likely indicative of systematic fraud, bureaucratic inefficiencies, and financial mismanagement. With the involvement of figures like Elon Musk and the proactive measures from DOGE, there is hope that meaningful reforms will bring greater accountability to Social Security. As taxpayer funds continue to be funneled into dubious payouts, the need for immediate action, transparency, and reform in Social Security oversight is urgent.

For further details, the full SSA 2024 Annual Statistical Supplement can be accessed here.